When it comes to retirement planning, choosing between a Roth IRA and a Traditional IRA is one of the most important financial decisions you’ll make. Both are excellent tools for building long-term wealth, but they differ in how and when you pay taxes—and that difference can have a major impact on your future savings.

This guide breaks down how each type works, their pros and cons, and how to decide which one best fits your financial goals.

1. Understanding the Basics: What Is an IRA?

An Individual Retirement Account (IRA) is a personal savings plan that allows you to invest for retirement with tax advantages. You can open an IRA through a bank, brokerage, or financial institution.

There are two main types:

-

Traditional IRA: Contributions are generally tax-deductible, but withdrawals in retirement are taxed as income.

-

Roth IRA: Contributions are made with after-tax income, but withdrawals in retirement are tax-free.

Both accounts let your investments grow tax-deferred, meaning you won’t pay taxes on interest, dividends, or capital gains as they accumulate.

2. How the Traditional IRA Works

A Traditional IRA is designed to give you a tax break now. Contributions are typically deductible from your taxable income, which can reduce your tax bill for the year.

Example:

If you earn $60,000 and contribute $6,000 to your Traditional IRA, your taxable income may drop to $54,000 (depending on your eligibility).

Key Features:

-

Tax-deferred growth: You don’t pay taxes until you withdraw funds in retirement.

-

Withdrawals taxed as income: When you start taking money out after age 59½, those withdrawals are taxed at your ordinary income rate.

-

Required Minimum Distributions (RMDs): You must start withdrawing funds at age 73, whether you need the money or not.

-

Contribution limits (2025): Up to $7,000 per year, or $8,000 if you’re 50 or older.

Best For:

-

People who expect to be in a lower tax bracket after retirement.

-

Those looking for a tax deduction today.

-

Individuals without access to employer-sponsored retirement plans like a 401(k).

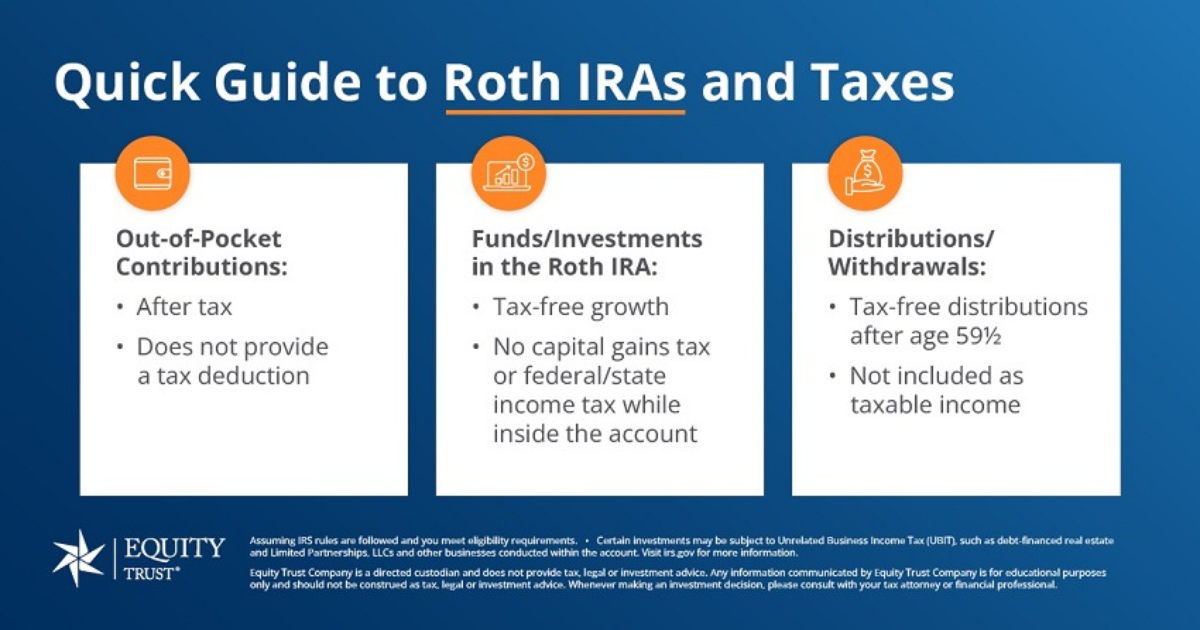

3. How the Roth IRA Works

A Roth IRA offers the opposite tax treatment—you pay taxes now, but your future withdrawals are completely tax-free, including the earnings.

Key Features:

-

After-tax contributions: You don’t get a deduction now, but you won’t owe taxes later.

-

Tax-free growth and withdrawals: All qualified withdrawals (after age 59½ and 5 years of account ownership) are 100% tax-free.

-

No RMDs: Unlike Traditional IRAs, you’re never required to withdraw money—allowing your savings to keep growing tax-free indefinitely.

-

Income limits: High earners may not be eligible to contribute directly. In 2025, contributions begin to phase out at around $146,000 for single filers and $230,000 for joint filers.

-

Contribution limits: Same as Traditional—$7,000 (or $8,000 if you’re 50+).

Best For:

-

People who expect to be in a higher tax bracket in retirement.

-

Younger investors who have decades for growth.

-

Those who value flexibility—Roth contributions (not earnings) can be withdrawn anytime without penalties.

4. Key Differences at a Glance

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax Treatment | Tax-deferred (deduction now, taxed later) | Tax-free growth (taxes paid upfront) |

| Withdrawals in Retirement | Taxed as income | Tax-free |

| Contribution Limits (2025) | $7,000 ($8,000 if 50+) | $7,000 ($8,000 if 50+) |

| Income Limits | None | Phased out for high earners |

| RMDs (Required Withdrawals) | Yes, at age 73 | No |

| Early Withdrawal Rules | 10% penalty before age 59½ | Contributions can be withdrawn anytime penalty-free |

5. How to Choose Between Them

The right choice depends on your current tax bracket, expected future income, and financial goals.

✅ Choose a Roth IRA if:

-

You’re early in your career and expect your income (and taxes) to rise in the future.

-

You prefer tax-free withdrawals later in life.

-

You want flexibility with no required withdrawals.

✅ Choose a Traditional IRA if:

-

You’re currently in a high tax bracket and want an immediate tax deduction.

-

You expect to be in a lower tax bracket during retirement.

-

You want to reduce your taxable income today.

6. Can You Have Both?

Yes! You can contribute to both a Roth and a Traditional IRA in the same year—as long as your total contributions don’t exceed the annual limit ($7,000 for 2025).

This dual approach gives you tax diversification:

-

Some funds will be taxed now (Roth),

-

and others will be taxed later (Traditional).

It’s a smart strategy for those unsure about their future tax situation.

7. Final Thoughts

Both the Roth IRA and Traditional IRA are powerful retirement tools—it’s not about which one is “better” overall, but which is better for you.

If you’re young and have years ahead to grow your investments, a Roth IRA offers unbeatable long-term benefits with tax-free withdrawals. But if you’re focused on reducing taxes today, a Traditional IRA might make more sense.

Ultimately, a well-balanced retirement plan often includes both—providing flexibility, tax control, and peace of mind for the future.